Will feedlotting lambs make cents?

Geoff Duddy, Sheep Solutions

This scenario is provided as an example to illustrate how to use a calculator to consider the cost/benefit of finishing lambs. Given the season, many lambs may be a lighter weight, at entry and finish and have lower growth rates. The calculator can be used for accommodating whichever scenario you are looking at. Note that there will be a higher protein requirement relative to energy for lighter lambs and, of course, a longer feeding period to reach target weights which will impact profitability.

You can listen to the webinar where Geoff Duddy runs through the use of the calculator.

Industry overview

Seasonal conditions, supply patterns and market anomalies can have major impacts on prime lamb profitability.

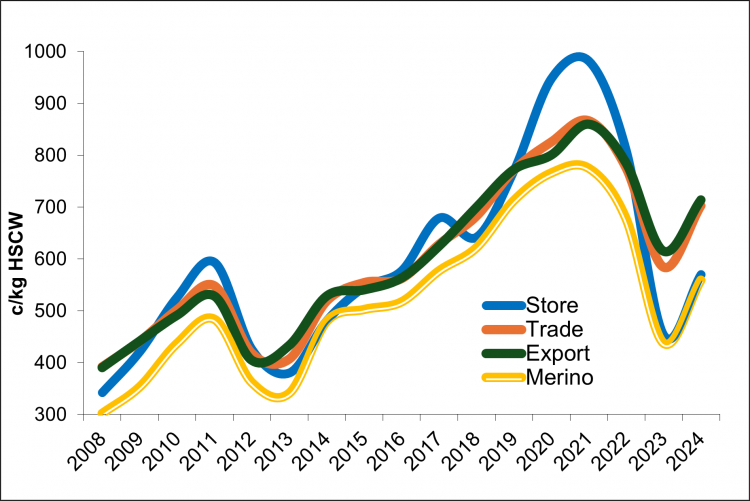

Figure 7 illustrates the long-term eastern states average store, trade, export and Merino lamb values since 2008. There are several patterns I’d like to discuss before we look at the viability of grain finishing lambs this year. Note that all categories follow the same price trends with differences in terms of price (on a cents per kilo basis) impacted by supply.

Figure 7 Eastern States Lamb Price Trends (2008 to October 2024)

- Historically trade lambs generally return more per kilo than heavier categories. There has been a pattern where every 4 to 5 years Exports out-perform Trade lamb categories for an extended period – we have been in one such period since spring 2022. Export categories have averaged 25c/kg more than trades during this time

- Merino lamb has, until 2022, traded around 50c/kg lower than trade lamb. This meant Merino carcases were returning between 90 to 93% of trade lamb values. When we factor in the strength of our lamb meat markets, a shift towards a dual-purpose style Merino and additional income from skins and/or wool returns the Merino has been extremely competitive in recent years. Greater differences between trade and Merino prices since 2022 is principally supply driven

- Store lamb demand is driven by seasonal conditions, availability and finished lamb returns. Between 2019 and 2022 store lamb values traded at or above finished lamb categories on a cents per kilogram basis. This made on-farm grain finishing risky at times in terms of achieving reasonable profit margins. I strongly advised clients to consider selling stores during this period particularly if the margin above their cost of production was greater than when finishing lambs. Since 2023 we have seen a decline in store lamb values relative to finished lamb categories as flock size and availability improved. At what stage does it become viable and profitable to finish these lambs within grain-based systems?

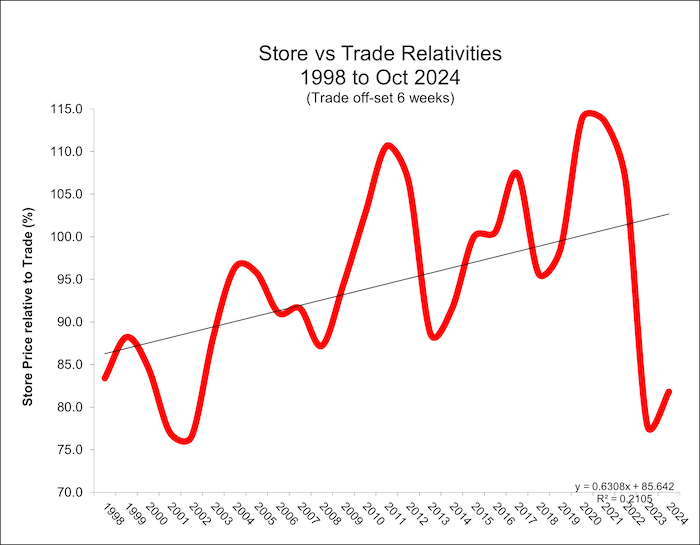

Store versus trade price trends

A store lambs value continues to be the largest cost when feeding lambs – around 55-65% of total costs when finishing to trade weights. Feed normally constitutes 25-30% of total costs

Regardless of whether an ‘own-bred’ or ‘purchase-in’ system it is important that you consider not only the actual c/kg HSCW price but that you also look at the relative price of ‘store’ lambs to finished lamb categories. Years of analysis suggests that store lamb values in eastern states need to be trading at or below 85% (relative to trade lamb values on a c/kg HSCW basis at time of sale) when feedlotting to minimise risk and provide opportunities for reasonable profit margins.

Figure 8 illustrates the value (c/kg) of store lambs relative to Ttade weight lamb values 6 weeks later (to simulate prices received for trade weight lambs 6 weeks after buying/finishing 17-18kg store lambs). I call this the ‘store lamb relativity’ value.

An example of how to calculate this store lamb ‘relativity’ value is shown below:

17kg store lamb, $120 landed on-farm = $120/17 = 700c/kg (skin value included)

23kg trade lamb, $180 (gross) sold = $180/23 = 782c/kg

700c/kg / 782c/kg = 0.89 (89%)

Note: This relativity value does not equal gross sale value for trade divided by gross store lamb value. $120/$180 = 0.767 or 67% not the 89% shown in the example above

We have seen a significant drop off in store lamb values and relativity over the past 2 years due principally to supply. The consistently high store lamb values have made grain finishing reasonably risky in recent years – store lamb values relative to trade values, in my opinion, need to be trading at or below 0.85 (85%) to minimise risk and provide opportunities for reasonable profit margins to be achieved.

The red line in Figure 8 depicts the store lamb relativity values since 2012. Reading from the ‘Y’ axis:

- 100% is when store lamb values (on a c/kg basis) are the same as trade lamb sale values 6 weeks later

- 95% represents the point at which pasture finishing should be reasonably profitable with limited risk. Pasture finishing is generally cheaper than grain-finishing due to lowered costs for feed, labour and depreciation on infrastructure costs etc. A higher relativity value can therefore be factored in without a significant impact on likely profit margin(s)

- 85% or higher represents the point at which I believe grain-based finishing is risky in terms of profitability. The store lamb relativity has sat at or below 85% for the past 12 months – the first time we have seen an extended low relativity value for many years. This should bode well in terms of achieving reasonable profit margins when feedlotting lamb in the near future.

So does feedlotting make ‘cents’?

The following analysis was undertaken using current price data and the Sheep CRC Feedlot Calculator. I co-developed the calculator with Dave Stanley and Steve Semple while with NSW DPI. It can be downloaded from dpi.nsw.gov.au/animals-and-livestock/nutrition/feeding-practices/feedlot-calculator.

Background data:

- 3 store lamb prices ($95, $115 and $135)

- 3 finished lamb prices – 750c, 800 and 850c for 23kg ($179.20, $191 and $202.75) and 28kg carcases ($214.50, $228.60 and $242.70)

- ration cost of $405 as fed ($450 on dry matter basis) for a barley/lupins and cereal hay with mineral supplements (salt/acid buf) mix

- ME 11.4 MJ and CP 16%

- 280g/h/d growth rate (includes 2-week introduction period)

- lambs consume 4.2% of their liveweight daily)

- lambs on feed 33 days (23kg analysis) and 71 days (28kg analysis)

- 1% deaths, 2% shy feeders

- drench, vaccines etc included

- $13/tonne machinery running costs

- 5c/lamb/day labour cost (self-feeders)

- no shearing costs (assume shorn prior to purchase OR costs/income allocated to normal running costs if home-bred) or capital costs included

- $5/head transport cost

- 5.5% sale commission/yard fees etc.

Findings:

Buy In Price | $95 (560c) | $115 (676c) | $135 (794c) | ||||||

Sale Price 23kg | $179.25 | $191.00 | $202.25 | $179.25 | $191.00 | $202.25 | $179.25 | $191.00 | $202.25 |

StoreLamb Relativity (%) | 75 | 70 | 66 | 90 | 85 | 80 | 105 | 99 | 93 |

Profit | 27.50 | 38.41 | 49.32 | 7.35 | 18.25 | 29.16 | -12.81 | -1.90 | 9 |

Sale Price 28kg | $214.50 | $228.60 | $242.70 | $214.50 | $228.60 | $242.70 | $214.50 | $228.60 | $242.70 |

StoreLamb Relativity (%) | 73 | 69 | 65 | 88 | 83 | 78 | 104 | 98 | 92 |

Profit | 18.01 | 31.08 | 44.14 | -2.30 | 10.76 | 23.82 | -22.61 | -9.50 | 3.51 |

Discussion

Looking at analysis outcomes it’s reasonably safe to say that there is potential going forward for producers to achieve reasonable profit margins when grain finishing lamb. Points of interest are:

- profits margins rely heavily on the buy-in store lamb price with profit margins lower when targeting export weight lamb due to the increased cost (and share of total production costs) of the ration, increased labour costs and commissions etc

- store lamb cost as a percentage of total costs reduces when targeting heavier weights (between 49 to 61%) compared to 64 to 71% if finishing to trade weight

- ration cost as a percentage of total costs increases when targeting heavier weights (between 31 to 37%) compared to 17 to 22% if finishing to trade weights

- because of the lowered store lamb prices of late, strong finished lamb prices and the reasonably low ration cost the store lamb relativity target of 85% is easily reached. The 85% point beyond which profits drop holds true if looking to take lambs through to heavier carcase weights while a relativity of 90% will still provide reasonable profits if targeting trade lamb weights.

Take home messages are many

Before making the decision to feedlot producers should consider:

- the availability of contracts

- any seasonal price variations

- store price relativities

- feed storage/availability and price etc.

Crunch the numbers using the Sheep CRC Feedlot Calculator and make an informed decision!